r&d tax credit calculation uk

RD Tax Credit is 212500 1453081250 CT600 boxes 530875 Losses to carry forward are zero. Comprehensive Hasty Service.

R D Tax Credit Calculation Methods Adp

If the company spent 100000 on RD projects in a year.

. Deduct an extra 130 of their qualifying costs from their yearly profit as well as the normal 100 deduction to make a total 230. Is only available to Limited companies. If in 2022 A to Z Construction had qualified.

Fifty percent of that average would be 24167. The UK Government introduced research and development tax credit schemes RD schemes in the year 2000 to encourage scientific and technological innovation within the UK. Ad ForrestBrown is the UKs leading specialist RD tax credit consultancy.

The average R. Just follow the simple steps below. The RD tax credit is for taxpayers that design develop or improve products processes techniques formulas or software.

How to calculate RDEC To calculate your expenditure you need to. Relief of 230 of R. Submit HMRC RD Tax Credit Claims via Direct RD.

Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors. Ad ForrestBrown is the UKs leading specialist RD tax credit consultancy. The RD tax credit was first established in 1981 in the Economic Recovery Tax Act ERTA.

If youre a loss-making business youll receive your RD tax credit in. The initial credit equaled 25 percent of a corporations research spending in excess of. Its calculated on the basis of increases in.

So if your RD spend last year was 100000 you could get a 25000 reduction in your tax bill. Ad We Are RD Tax Claims Specialists With A Low Fee Of 5 On All RD Claims. This calculation example shows how RD tax credits can benefit a.

Ad We Are RD Tax Claims Specialists With A Low Fee Of 5 On All RD Claims. Free RD Tax Calculator. Paid within 4 weeks of submitting claim.

A to Z Constructions average QREs for the past three years would be 48333. 53bn of R. Select either an SME or Large.

Enhanced RD qualifying spent would be now 325000 x 130 which makes the revised loss of 275000. Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief. One of the hard issues to understand about RD Tax.

Corporation Tax before RD tax credit claim. SME RD relief allows companies to. Comprehensive Hasty Service.

Submit HMRC RD Tax Credit Claims via Direct RD. Work out the costs that were directly attributable to RD. Calculate how much RD tax relief your business could claim back.

Reduce any relevant subcontractor or external. Steps to calculate the RD tax credit via the traditional method 2 Total the QREs for the current tax year Determine aggregate QREs over a base period Divide the aggregate QREs by the. The rate of relief is 25.

Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors. Average calculated RD claim is 56000. Profitable and loss making large companies equaly can benefit both potentially obtaining a RD Credit of 97 of their RD spend.

100000 x 130 130000 uplift 400000 130000 270000 revised profit 270 000 x 19 51300.

Probability Lessons Probability Of Compound Events Probability Lessons Probability Worksheets Probability

Calculate Your Net Worth With This Personal Balance Sheet Balance Sheet Template Balance Sheet Cash Flow Statement

Erp For Growing Companies Sme Smallbusiness Ocean Systems Business Business Process

Retail Billing Software Billing Software Invoicing Software Accounting

R D Tax Credit Calculation Examples Mpa

Rdec 7 Steps R D Tax Solutions

Excel Calendar Template Excel Calendar Template Excel Calendar Excel Templates

Invoice Or Bill Discounting Or Purchasing Bills Trade Finance Accounting And Finance Financial Strategies

Browse Our Example Of Non Profit Start Up Budget Template Budget Template Spreadsheet Template Budgeting

R D Tax Credit Calculation Adp

R D Tax Credit Calculation Examples Mpa

Ibn Tech Provides Bookkeeping Accounting Online Bookkeeping Offerings For Small Businesses Ibn S Eleven Plus Years Of Bookkeeping Enjoy With Images Bookkeeping Services

Federal Method Expected Family Contribution Efc In Fafsa Calculation Expected Family Contribution College Savings Plans Saving For College

R D Tax Credit Calculation Examples Mpa

Macrs Meaning Importance Calculation And More In 2021 Financial Management Financial Strategies Finance

R D Tax Credit Calculation Examples Mpa

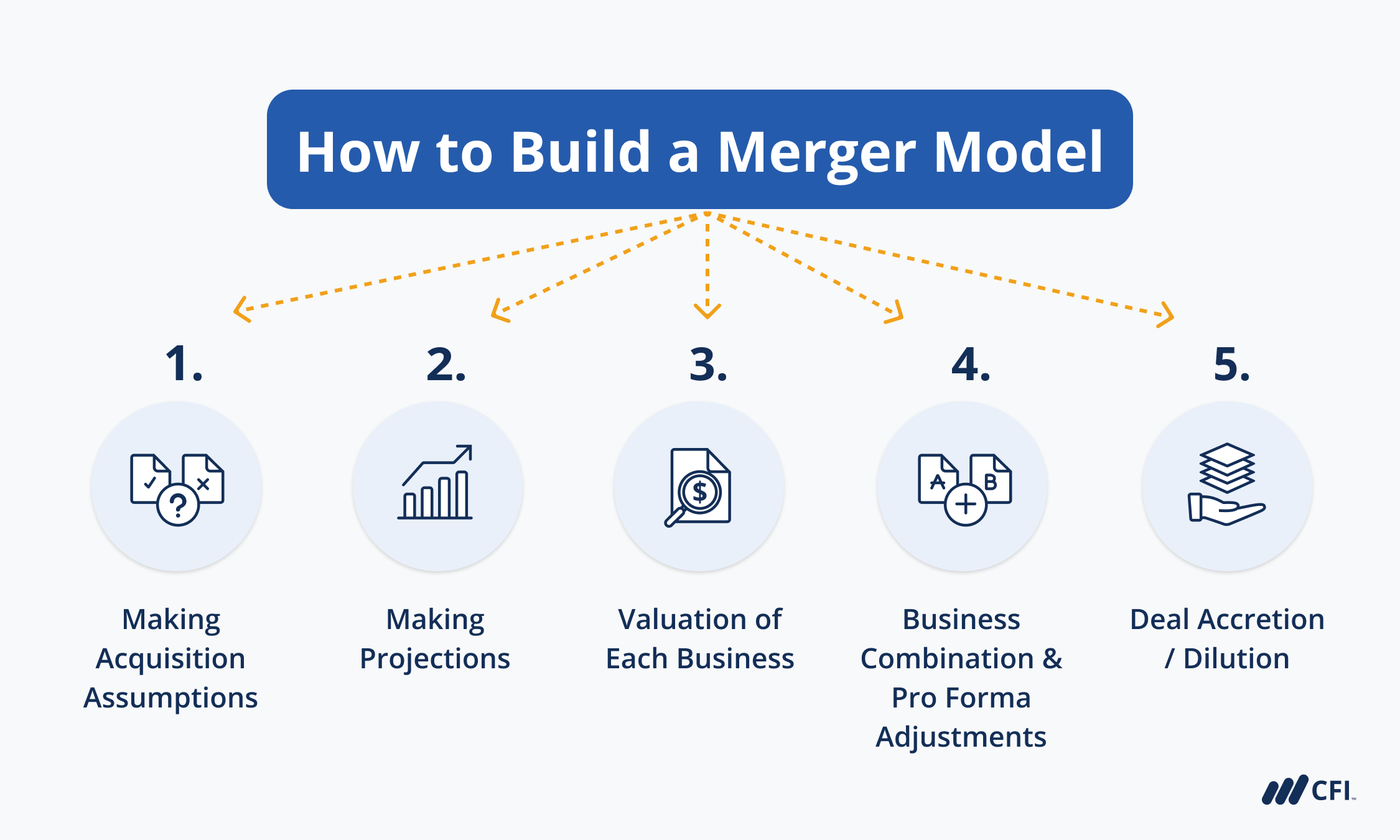

How To Build A Merger Model A Basic Overview Of The Key Steps